Alexander Kirn established Germany’s first official Search Fund in Cologne in 2009, successfully acquiring and continuing to lead two technology companies, INVERS and LapID. Since then, the Search Fund model in Germany has developed at a steady pace, gradually gaining traction as a viable path for both entrepreneurs and investors, especially in light of the country’s current economic and demographic landscape.

At Moonbase Capital, we are excited about the potential of the German market and already support a number of active searchers in the region, working closely with our partners at Seqos, the Search Fund accelerator based in Germany.

This article takes a closer look at the German Search Fund landscape with its opportunities and challenges.

We reference public data, industry articles, and insights from in-depth interviews we did with three of our active searchers in Germany: Lisa Stuhler, the first solo female search fund entrepreneur in the country and founder of Tilia Nachfolgekapital GmbH, as well as Anton Stockert and Stephan Pöll, co-founders of ASPEON Partners.

Germany’s Emerging Search Fund Landscape

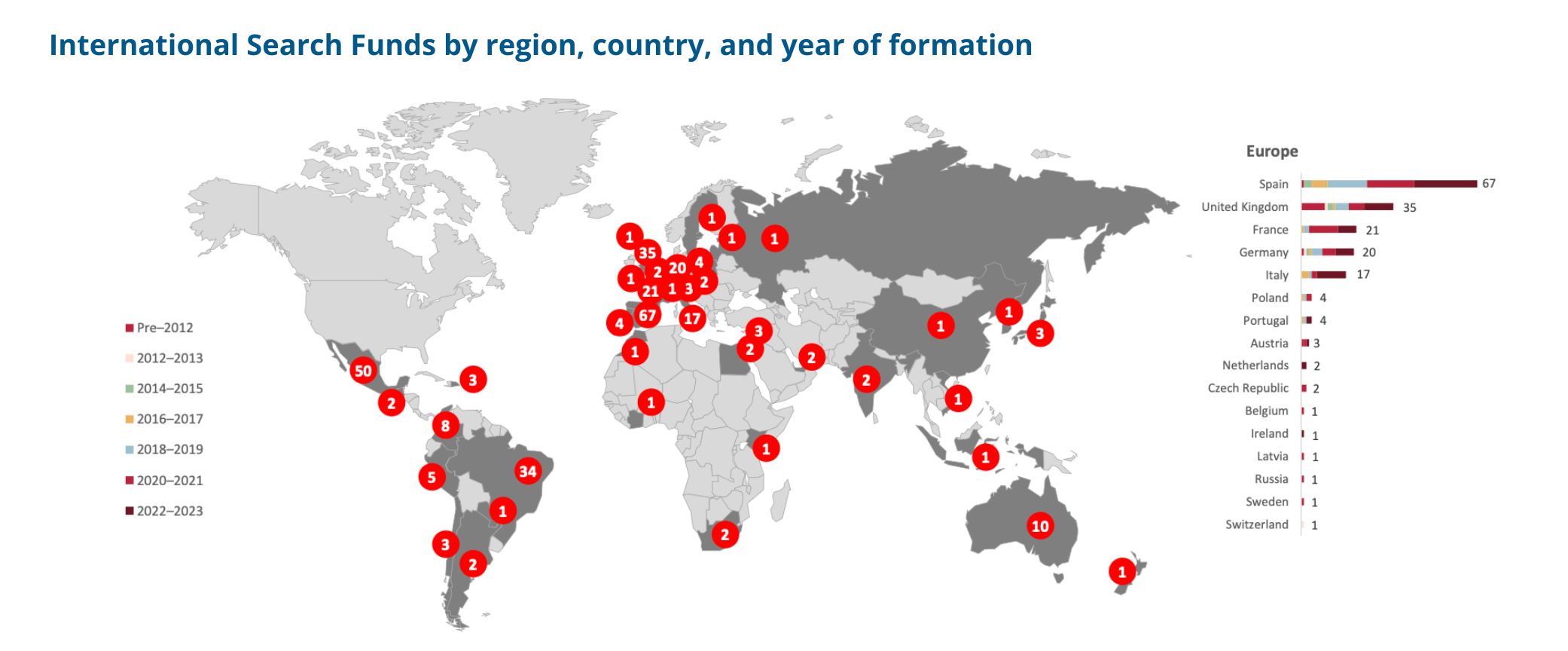

According to the IESE 2024 Search Fund Report, Germany has seen the launch of 20 Search Funds since 2009, with 10 of them completing acquisitions, most of which occurred between 2022 and 2023.

Despite this growth, the Search Fund model remains relatively unknown in the DACH region. A 2022 Germany-based study on Search Funds places that on a lack of awareness about the model. Most entrepreneurs, investors, and business owners are either unfamiliar with or only vaguely aware of this particular model of entrepreneurship through acquisition.

Additional factors limiting the model’s prominence in the region include skepticism among older generations of SME owners, a traditional mindset toward business development, and strong competition from well-established private equity firms.

Nonetheless, the outlook for Search Funds in Germany is optimistic. As demographic, economic, and social shifts continue to unfold, the conditions for growth and expansion of the model are steadily improving.

Germany’s SMEs and Family Businesses: The Backbone of Europe’s Largest Economy

Germany’s “Mittelstand” — its small and medium-sized enterprises (SMEs) — form the backbone of the national economy. Their role is not only economic but also deeply social, providing stability and employment across the country.

As of 2022, there were 3.4 million SMEs in Germany, accounting for 99.2% of all businesses. These companies generated 27.3% of total national turnover and employed 53.6% of the workforce, according to the Institut für Mittelstandsforschung (IfM) Bonn.

In Germany, family businesses are often multigenerational enterprises, with many having been led by the same family for decades, sometimes across three, four, or even five generations.

Remarkably, 52% of these companies are led by CEOs from the third, fourth, or even fifth generation—well above the global average of 20% – according to a 2024 KPMG Report.

The same report finds that sector-wise, German family firms are heavily concentrated in manufacturing and services, each accounting for 42% of the total, though their emphasis on manufacturing is significantly higher than the global norm.

The top 500 German family businesses alone generated $1.8 trillion in annual revenue in 2023, contributing nearly 43% of the country’s GDP. While household names like Volkswagen, BMW, and the Würth Group dominate headlines, the sector is also home to thousands of “hidden champions”—niche-market leaders that quietly excel on the global stage.

From Bavaria to Brandenburg: The Geographic Mosaic of German Enterprise

Germany is composed of 16 federal states, or Länder, with a combined population of about 84 million people as of 2025; approximately 78% of the population lives in urban areas, reflecting a high degree of urbanization. The states vary widely in size and economic focus, with large urban centers like Berlin, Hamburg, and Munich, and industrial heartlands such as North Rhine-Westphalia, Baden-Württemberg, and Bavaria.

Business activity is distributed unevenly. According to a 2018 report by KfW SME Atlas, states like Schleswig-Holstein see SMEs employing up to 93% of the workforce, compared to only 58% in Berlin.

Rural areas typically have a higher concentration of SME employment and a more traditional business culture, while urban centers are more innovation-driven.

This regional divide has important implications for Search Funds: rural areas may present more acquisition opportunities, though often in less scalable or tech-enabled industries.

Lisa Stuhler: The main differentiators I’ve observed are more about rural versus urban locations and the age of the business owner. There’s also a stark contrast between, say, modern performance marketing agencies and traditional family-owned businesses. Each deal is unique, but these factors definitely influence the conversations and negotiations.

Headwinds on the Horizon: The Perfect Storm Facing German SMEs

Despite their historic resilience, German SMEs currently face mounting challenges. The European Commission projects continued economic stagnation in Germany, following two consecutive years of decline.

Key pressures include:

-

Rising Energy Costs: Nearly two-thirds of SMEs report being significantly affected, with many struggling to maintain profitability. Some have reduced consumption or passed on costs, but a growing number are under financial strain.

-

Demographic and Generational Shifts: An aging population and workforce transitions are reshaping the SME landscape.

-

Administrative Burdens: Complex regulatory frameworks and bureaucratic inefficiencies continue to weigh heavily on smaller businesses.

These factors are collectively weighing on the sector’s short- to mid-term growth prospects. Compounding the challenge is a looming succession crisis—one of the most significant opportunities for Search Funds in Germany today. Let’s take a close look at it.

A Trillion Euro Handover: Germany’s Succession Crisis

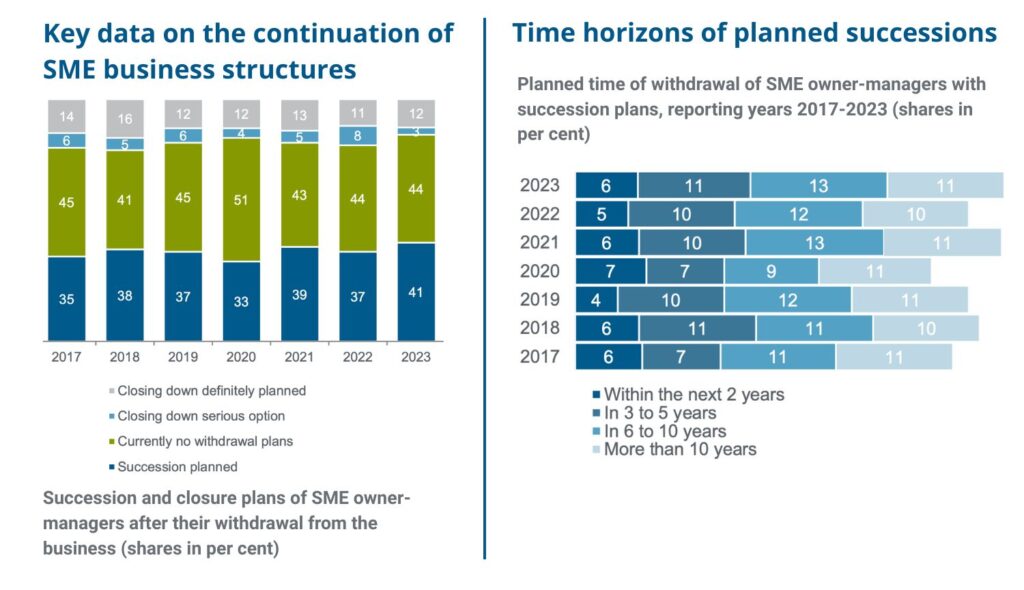

According to KfW Research, an average of 125,000 SME owners in Germany will seek to hand over their businesses each year until the end of 2027. However, the number of actual takeovers falls far short of this need, signaling a deepening succession gap.

Demographic trends are accelerating the issue: approximately 1.2 million entrepreneurs, or one-third of all SME owners, are now over the age of 60.

The same report from KfW Research tells us the number of owners actively planning for retirement and seeking successors is increasing rapidly.

By the end of 2026, around 560,000 businesses will be looking for a successor. Without adequate transition planning, up to 250,000 businesses could be forced to shut down over the next five years.

In fact, the number of SME owners considering closure due to the lack of a viable successor has reached an all-time high, with 231,000 businesses at risk of closing by the end of 2025.

The growing succession gap presents one of the most significant opportunities for Search Fund entrepreneurs in Europe. However, Entrepreneurship through Acquisition (EtA) in Germany comes with its unique cultural challenges.

Let’s take a closer look.

Tradition Meets Transition: Navigating German Business Culture as an Outsider

Fun fact: One of our German searchers purchased a robot that handwrites letters—proof that a personal touch goes a long way in a market with a strong tradition of formality and relationship-building.

Having invested across Europe, we’ve seen firsthand that Entrepreneurship through Acquisition (EtA) in Germany can be particularly challenging for young, non-technical buyers. Many German entrepreneurs are understandably cautious about selling their life’s work to external acquirers, especially younger or less-experienced ones.

In an interview with Search Funds News, Christian Gieger and Benedikt von Hatzfeldt, Founders of Tembo Search Partners, shared how their partnership with the family-run investment firm Münchmeyer Petersen & Co. (MPC) has been crucial. Beyond providing capital, MPC adds significant credibility and authenticity—qualities that are invaluable when engaging with Mittelstand business owners.

German business culture places a high value on trust, long-term relationships, and stewardship. Sellers often seek reassurance that their company’s legacy will be respected and continued under new ownership.

Building Tomorrow’s Mittelstand: The Path Forward

Germany’s SME landscape is one of the most significant in Europe, economically vital, yet increasingly strained by demographic and structural pressures. While the Search Fund model is still gaining traction, its potential is clear. A growing number of high-quality businesses need thoughtful succession, and a new generation of entrepreneurial operators is stepping up to fill the gap.

At Moonbase Capital, we’re committed to supporting the growth of the German Search Fund ecosystem. We’ll continue updating this article as the market evolves.

Please help us make it even more useful by sharing your thoughts, feedback, or relevant data sources.