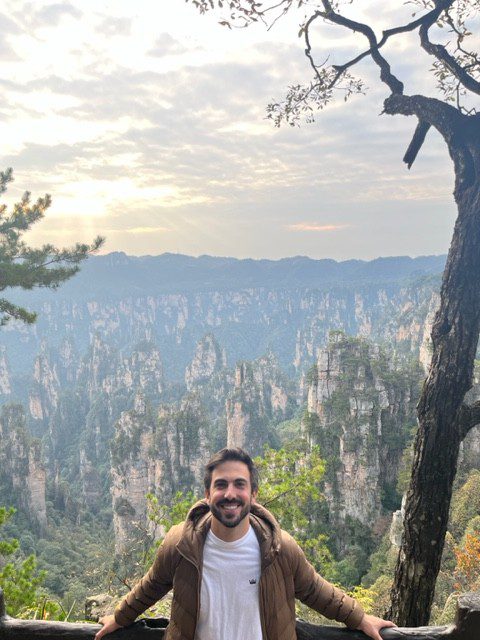

Have you ever wondered what it takes to become a successful search fund entrepreneur? In this edition of Search Fund Squared, we sit down with Pedro Dorea, a Brazilian search fund entrepreneur who shares his unique insights and experiences on his journey to acquire and manage a company.

Pedro’s background is a testament to his curiosity and desire to learn. With a mechanical engineering degree, he has worked in various industries, including oil and gas, retail automotive, and chemicals. His eight-year stint at a medium-sized chemical company provided him with valuable experience in managing teams and driving revenue growth. Pedro then transitioned to consulting, where he gained a broader perspective on assessing different firms and industries.

In this interview, Pedro shares his motivations for pursuing an MBA and subsequently working with a search fund investor, which equipped him with the knowledge and skills to become a searcher himself, thus founding Minerva Capital. He also discusses the importance of networking within the search fund community and how it has contributed to the growth of the model in Brazil.

MC: What made you decide to go and do the MBA and then subsequently into search fund investing?

Pedro: When you’re young and working hard within a company, you start to develop deep expertise in that specific industry. As your understanding grows, so does your career, but by the time I was 27, I realized I was becoming too specialized. I was concerned that this could limit my broader development and reduce my chances of reaching my ultimate goal of becoming a CEO. That’s why I decided to pursue an MBA—to broaden my perspective by studying different industries and businesses before choosing where I wanted to focus long-term. The decision to move into search fund investing was a natural extension of this. It allows me to analyze companies in depth before committing to one where I can take on a leadership role and apply what I’ve learned.

MC: How did you hear about search funds from there to begin with?

Pedro: The first time I heard about search funds was during an entrepreneurship class, but initially, I thought it was too far removed from my network, and therefore, it seemed like a difficult path to pursue. That changed when a friend introduced me to a Brazilian searcher who had just acquired a company. From there, I began connecting with others in the search fund community. I first focused on searchers in Brazil, since that’s where I wanted to search, but eventually expanded to international connections to gain a broader perspective. Once I felt more confident, I started engaging with investors, who ultimately supported my decision to pursue the search fund model.

One key investor was Istria Capital, which offered me a position to work with them, allowing me to better understand the investor’s perspective and gain valuable experience with the model before launching my own search fund, Minerva Capital.

MC: Is there an industry that you have identified that has great potential within your market that you are more interested in than others, or is it just kind of a broad spectrum of everything?

Pedro: We approach this by focusing on three industries at a time. Currently, we’re analyzing accounting, facilities management, and waste management. Since these are broad sectors, we break them down into sub-industries to gain a clearer understanding. For example, in waste management, we look at organic versus non-organic waste, and further divide it into solid or liquid waste. This helps us better assess the sub-industry’s dynamics, benchmarks, risks, and growth opportunities. Once we’ve gathered enough data on a sub-industry, we use a scorecard to evaluate whether it aligns with the search fund model and fits our specific criteria.

MC: What advice would you give an aspiring search fund entrepreneur?

Pedro: My advice is to start by assessing yourself—your strengths, your experience, and how you can leverage them to become a good searcher and ultimately a good CEO. This requires deep self-reflection, almost like doing ‘due diligence’ on yourself. One effective approach is to review your past work experiences, especially those closely related to the search fund model.

In my case, I used my time at Istria to identify the skills that would help me succeed both as a searcher and later as a CEO. You also need to demonstrate to your investors that you are the right person for them to back. They are not only key to your fundraising efforts but also long-term partners, as you’ll likely be working with them for many years. While talking with investors, it is important to do ‘due diligence’ on them by asking yourself: does this investor have the right skills or strengths to help me? Can I see myself creating a solid and lasting partnership with them? With that mindset, you can build a strong cap table that will greatly increase your chances of success.