The Private Equity market is extremely wide and includes various forms of investments including buyouts, growth equity, turnarounds, and more.

Search Funds have narrowed the traditional Private Equity space and honed down these opportunities to a specific set of criteria. Data shows that investments that follow these criteria outperform traditional Private Equity strategies and deliver higher returns.

IRR of Search Funds vs other asset classes

At Moonbase Capital, we have calculated that a Search Fund investor will receive an IRR of 26% if the fund achieves an IRR of 33%. We have conducted research and found that the following metrics must be reached after 5-6 years for a Search Fund to reach an IRR of 33%:

Exhibit 3 Moonbase analysis, Stanford 2020 Search Fund Primer

According to our models and forecasts, these metrics are easily achievable. They are further supported by Stanford’s study showing that Search Funds generated an average IRR of 32.6% and a return on invested capital of 5.5x in 2019.

This IRR return is even more significant when compared to the top quartile of Venture Capital and Private Equity funds in the US. These funds had an average return of 24% and 19% respectively from 1995 to 2018 according to research from Cambridge Associates.

In this article, we will explore some of the reasons why Search Funds typically yield higher returns when compared to other asset classes.

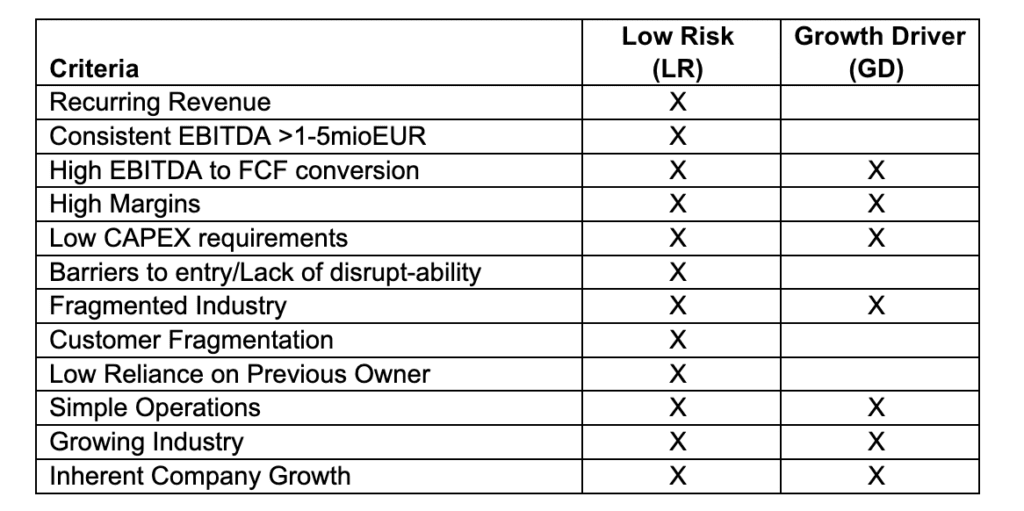

Benefits of the Search Fund criteria

The Search Fund criteria aims to exploit a delicate balance between low risk and high leverage in investment decisions. Think of it like a revenue-generating real-estate investment, but with significant revenue growth potential. Real estate assets are heavily leveraged at acquisition. Investors aim to sell in a few years at a higher price, maintain a stable low-risk positive cashflow to safely pay interest, and in the best of cases a chance to pay back the acquisition leverage before selling, giving the owner a chance to refinance or sell at a much higher equity value.

A Search Fund investment carries much of the same characteristics. Investments are made with acquisition financing structures that can reach up to 80%. Due to the absolute lack of investment options in SMEs, an arbitrage in the acquisition/exit multiple is very attainable. This is because at the target of 1-5Mio EUR EBITDA, an SME is too small for most strategic multinational investment, is uninteresting to VC funds, and is below the minimum ticket size of mainstream PE funds.

The target of the Search Fund is to, within 5-7 years, grow the business within the threshold of interest of Strategic investments and PE firms, a sweet-spot for higher multiples. In addition to that, the target of a search fund is to pay back from the free cash flow of the acquired company the acquisition finance debt, this further amplifies the returns on exit.

The search fund criteria, below, is designed to guide Search Funds to find optimal SMEs that can cradle the stable growth and low-risk environment necessary for this delicate balance to work consistently:

Recurring revenue (LR)

Recurring revenue ensures that the company has a steady and predictable cash flow stream. This increases stability as the company can forecast revenues at higher certainty and plan expenses, accordingly, allowing the owner to manage cash flow optimally. It also helps cushion cash flow during the transition time between the legacy owners and the new ownership. It allows the new ownership to have time to learn while the current operation is still positive and generating cash, not needing to acquire new customers within that critical time period. It is, if we look at the real estate example again, like rent.

Consistent EBITDA of at €1-5m (LR)

A consistent stable EBITDA of €1-5m indicates that the company is somewhat robust and has been operating positively for some period of time. It also suggests that the company is fairly stable and has persisted through various economic climates. It also ensures that the company is not too small to reach a potential interest of PE and strategic investment within 5-7 years on exit, and not too big to be already in the sweet-spot on acquisition. It is, if we look again at the real estate example, like buying a property in a little-known area that will be developed, in the hopes of selling it at a much higher price later when it gains popularity and becomes a sought-after property.

High EBITDA to FCF conversion (LR + GD)

The target is to pay back all the acquisition debt before exit. Therefore, it is extremely important to ensure that the company can generate free cashflow from its EBITDA in a systematic manner, that is inherent within its business model. Companies that are significantly cash flow positive are generally less likely to run into liquidity problems reducing the risk of defaulting or being late on debt payments. They are also far more likely to have maintain healthy working capital during difficult times which ensures smoother operations and less risk.

Furthermore, companies that can generate free cash flow have much more autonomy and flexibility for growth of new business lines and through roll up acquisitions.

High Margins (LR + GD)

A business with high EBITDA margins has a bigger margin of error which helps “de-risk” the time of transitioning and at times of economic downturn. Furthermore, it also allows more room for operational maneuverability and scale up without slipping into “red digits”. This gives much more breathing room for the entrepreneur to grow the business.

Low CapEx requirements (LR + GD)

Acquiring a company with a low CapEx allows for more free cash flow (FCF) which can then be reinvested in the business to repay the acquisition loan or fund business growth. Lower CapEx also ensures that the SME’s growth is not reliant on further financing requirements, whether equity or debt. This significantly decreases risk and simplifies the financial barriers to growth. It also comes as a prerequisite to high FCF conversion, especially at a time with increasing interest rates.

Barriers to entry and a lack of industry disrupt-ability (LR)

An industry with high barriers to entry means that it cannot be disrupted easily by new entrants to the market. These markets are also less likely to be targeted by VC backed companies which can be highly disruptive as they have large financial backing and can afford to take a loss in order to gain market share.

Fragmented industry (LR + GD)

Operating in a fragmented industry means there are no dominant high market share competitors. This is important as a large competitor is more able to benefit from economies of scale and is likely able to offer the same product at a cheaper cost. This is especially relevant for companies with high reliance on R&D, as large competitors will almost always be able to outpace the R&D of smaller companies. This makes it harder to acquire customers from a large tenured competitor as they are also likely to have a loyal customer base and higher brand recognition.

Furthermore, within a fragmented industry a business with an EBITDA of 1-5mio EUR will usually have a fairly good reputation in the market making customer retention and acquisition easier.

Operating in a fragmented industry provides the business with opportunities to carry out rollup strategies. Consolidation of the industry under the acquired company is a large value creation lever and allows the SME to benefit from synergies and expand market share at a rapid pace. It is a strategy that is often used in Search Funds.

Customer fragmentation (LR)

A diverse customer base ensures that revenues are not severely harmed if one customer decides to stop doing business with the company. It also ensures that no one customer has enough power to dictate prices and hold the business to ransom.

Low reliance on the previous owner (LR)

In small businesses, the owner is often the captain of the ship and is involved in many aspects of the day-to-day operations. It is imperative that the Search Fund entrepreneur can take over the key aspects of the business and that the business will not suffer too much with the owner’s exit.

Simple Operations (LR + GD)

Search Funds target companies with simple, well-structured operations. This ensures that the new manager can hit the ground running and streamline business processes quickly to maximize profits.

SMEs are also easy to manage when compared to the complexity of larger organisations that other Private Equity strategies typically deal with.

Growing Industry (LR + GD)

The business can ride the tailwinds of the industry. As the total value of the industry grows, the business has a larger opportunity to gain a larger piece of the pie.

Inherent company growth (LR + GD)

Companies with high inherent growth before acquisition give the Search Fund entrepreneur a good base to build from. These companies are already growing, and it is thus easier for the searcher to maintain or even increase this growth than if the company was stagnant.

The Criteria are Tried and Tested

SMEs represent 99% of all businesses in the EU, however, while there are many SMEs out there, there are a limited number that fit the Search Fund criteria. The Search Fund criteria might seem strict however in this blog we have outlined the reasons for their implementation and the value that each standard brings.

The first Search Fund was established in 1984, although there has been a significant increase in funds being raised recently, Search Funds are not a new concept and are tried and tested. By adhering to these criteria, Search Funds have been able to maintain a 33% IRR since their inception, stacking the odds in favour of the investor. The criteria provide Search Funds with a near surefire guideline on how to achieve the highest possible returns which makes the Search Fund model safe, easily understandable and accessible to investors.

How can I get involved with Search Funds?

The Moonbase Capital partners have over 50 years of experience acquiring, managing and exiting SMEs. We follow the Search Fund criteria set by Stanford and our team has the experience and knowledge to identify companies with the highest growth potential.

Get in touch if you would like to learn more about Search Funds. You can also find lots of useful information and resources on our website.